Technology is Changing Tax Rules in 2020

On January 6, 2020 the U.S. Internal Revenue Service (IRS) announced new focus on the gig economy and crypto currencies which the IRS calls “emerging compliance areas that require attention”. The law seems intended to bring crypto in from the cold and recognize the prevalence of gig work. The gig economy is also known as the sharing, on-demand or access economy. It usually includes businesses that operate an app or website to connect people to provide services to customers. While there are many types of gig economy businesses, ride-sharing and home rentals are two of the most popular.

Gig work and crypto trades are concentrated in metro areas. Cryptocurrencies are classified as property (rather than currency), which means both changes will disproportionately effect taxpayers in high price metro areas of New Jersey, New York and Texas.

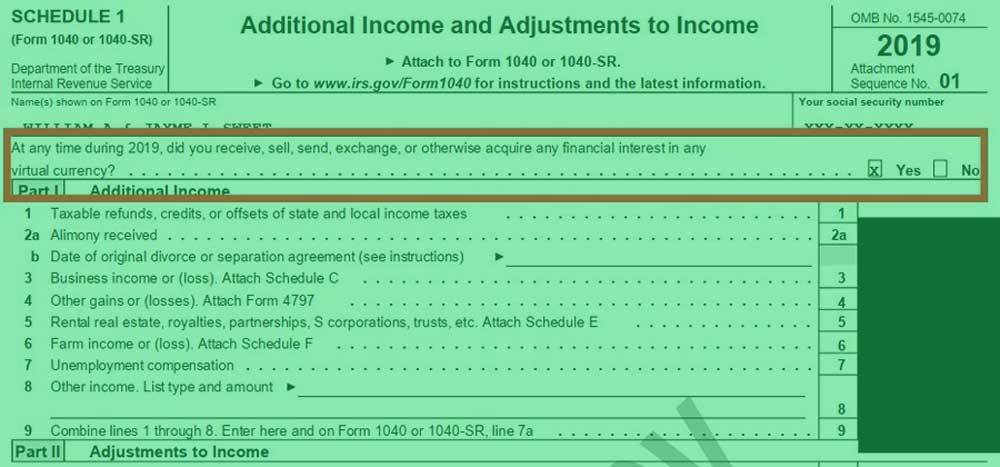

Specifically, the IRS added a new section to the Form 1040, which is used by over 152 million U.S. tax filers to file tax returns. The question is, “At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any interest in any virtual currency?”

Previously, the mention of crypto on your tax form risked an audit. Now, it appears that not mentioning it risks an audit. In 2019, 10,000 crypto traders who failed to properly report virtual currency transactions got warning “educational letters”. This year, the IRS appears poised to take action. The decision appears to formalize official guidance on cryptocurrencies published in 2014.

“At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

The IRS has issued guidance on tax treatment and reminds taxpayers of reporting obligations on its website as follows…

Using cryptocurrency to purchase any goods and services or exchange for other property, including other cryptocurrencies, will be considered as a capital gain or loss. “If you transfer property that is not a capital asset in exchange for virtual currency, you will recognize an ordinary gain or loss,” the IRS stated.

However, advocates don't accept that crypto currencies should stay in the shadows or won’t become mainstream. Advocates say lawbreakers trading in unreported crypto doesn’t really hurt anything.

What Should Taxpayers in New York, New Jersey and Texas Do?

Individuals and Small Business Owners would have to list their cryptocurrency sales, trades, and dispositions onto Form 8949 along with the date of acquiring the crypto currency, the date it was sold or traded, any proceeds (Fair Market Value), their cost basis, and their profit or loss. PayDay Masters helps you master crypto or gig work.

Tax filers in New Jersey, New York, Texas and all of the US are required to maintain records that support what they report on tax forms. In this manner, it's best practice to keep records archiving receipts, deals, trades, or virtual currency transactions.

This new tax reform development has come along with the proposed New Jersey Freelancer law. Read more here,

Leave a comment (all fields required)